Description

-

Target Audience

✔️ The card is available only for new customers of AU Small Finance Bank.

✔️The customer should be a resident of India.

✔️The customer should be 18 years and above.

✔️The card is available only for users who already have a credit card.

✔️The customer should have at least 30,000 limit on his previous credit card.

Documents Required

✔️ Valid Aadhaar Card

✔️ PAN Card

✔️ Income proof

✔️ Address proof

Step by step process

✔️ Share the link with everyone in your network (friends/customer).

✔️ Customer has to check eligible pincode via submitting basic details on the BankSathi lead page through the link which you have shared with your customer.

✔️ The customer then needs to enter their mobile number (linked with Adhaar and PAN) and PAN card at the initial landing page of AU SFB.

✔️ In the next page customer has to enter their Adhaar card number and submit OTP generated to authenticate their Adhaar.

✔️ The customer then enters the first 6 digits of their existing card and the offer from AU SFB’s SwipeUp platform.

✔️ Customer is then shown a comparison page between his/her existing card and the offer generated by AU Small Finance Bank.

✔️ After clicking on proceed the customer proceeds to the VKYC page.

✔️ While completing the Video KYC following points are to be ensured.

✔️ There should be no background noise and hence a quiet space is suggested while taking the VKYC.

✔️ PAN card, pen & blank paper should be handy with the customer.

✔️ The answers to following security questions must be known like Pin Code, Mothers name, DOB etc. Customer needs to remember all the details which were filled in the process.

Rules to Follow

✔️ Customers should have a Valid Aadhaar number and PAN card.

✔️ Customers should use the same number that is linked to their Adhaar while processing the application.

✔️ To be eligible for payout, customers must activate the credit card.

✔️ Your customer should make their first transaction within 30 days of card activation.

✔️ If a customer, who is also an employee of a financial institution, applies for a product from the same institution, they may not be eligible for the payout.

✔️ The customer’s address should be from eligible PIN codes.

✔️ You will get your payout only after the card is dispatched to the customer

✔️ Your customer should activate the credit card by making their 1st transaction within 30 days.

-

1. I have credit card of other bank. Should I apply or not?

Yes, Irrespective of any bank, if you have a limit of Rs. 30,000 or more you can apply for the swipe up card with AU Bank.

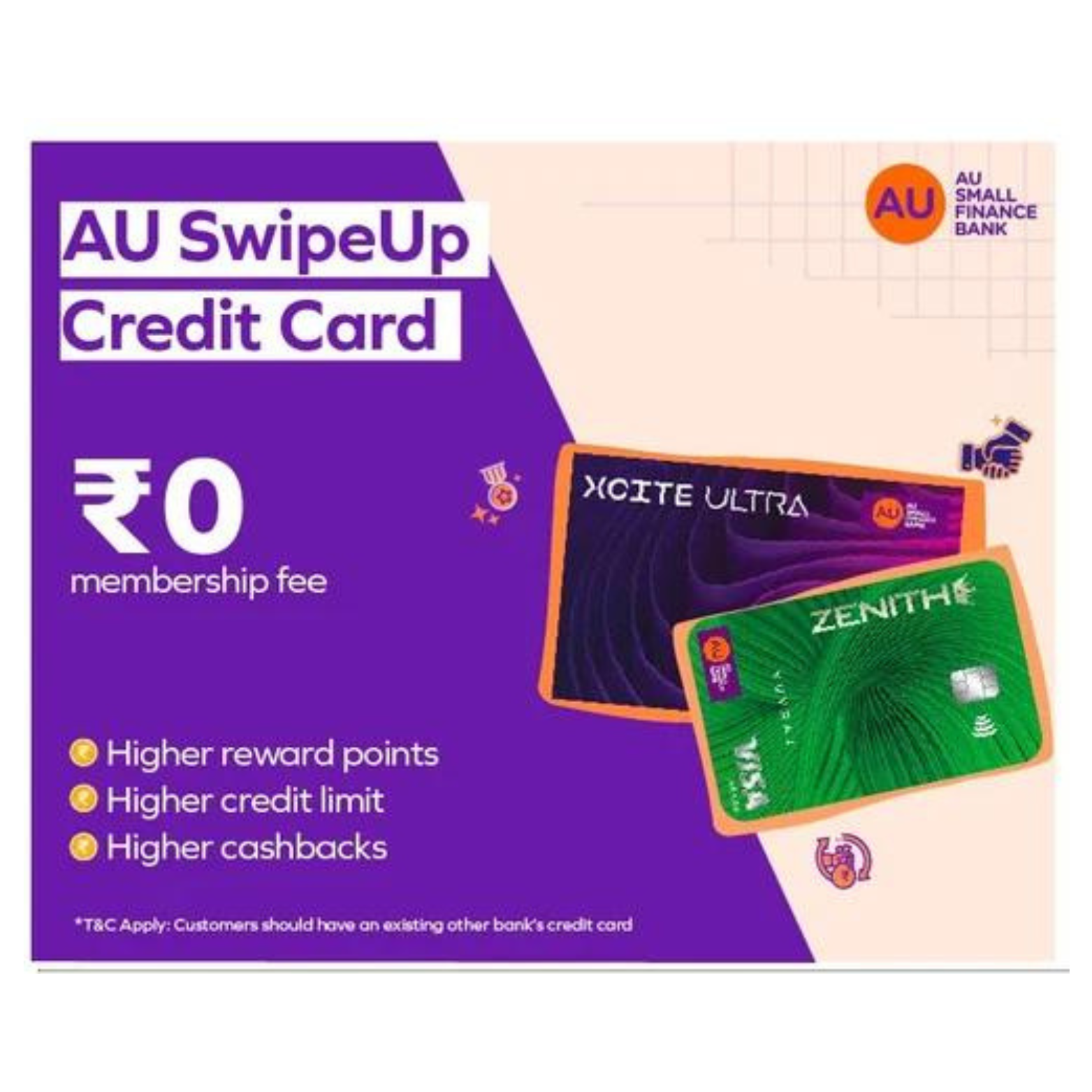

2. What is the plus point or profit in applying AU Swipe Up card?

With the AU Small Finance Bank SwipeUp Platform, you can get a credit card with more features and advantages than just a higher credit limit, such as higher reward points and cashbacks.

-

Reviews

There are no reviews yet.